2024’s Conforming Loan Limits Rise to $766,550: A Comprehensive Analysis

You already own a home, but your mortgage could probably be improved upon. Expertly fitting home loans is what Reliant Home Funding does best. We’re committed to finding the best home loan program and interest rate for you.

Get Started

Market interest rates may now be lower than they were when you got your mortgage. You can take advantage of this by refinancing to a lower interest rate.

Everybody’s circumstances are changing all the time. Refinancing can let you reduce your monthly payments to better suit your current situation.

If you have some equity in your home and want to take cash out, refinancing is a common and effective way to do so.

The terms of your loan might have suited when you took it out, but they could probably suit you better now. Refinancing lets you change your loan terms for a better fit.

Ready to apply? Get the ball rolling with our simple and secure online application – it only takes a few minutes.

Apply NowWe’re experts so you don’t have to be. Our experienced team will guide you through the process from start to finish.

Meet The Team

Whether you’re looking to buy or refinance, your first step is figuring out your budget. You can “Get Started” with us at the top right-hand corner of the page with a short questionnaire. Once complete, one of our loan advisors will contact you to talk about next steps. We look forward to hearing from you!

Pre-approval is a great way to narrow down what you can afford and will tell potential sellers that you are serious in purchasing a home. To get pre-approved, we look at your source of income, assets, debt-to-income ratio, and your credit score.

While credit score is important, there may be a loan that will work for your financial situation. Check out our rate calculator or contact us directly for more information.

The DTI (Debt-to-Income Ratio) is the monthly amount you owe divided by the monthly gross amount you earn. The DTI is a way for lenders to review your debt and find the loans you qualify for.

Student loans are a form of debt and can affect your DTI ratio, but there are usually home loan options that will work depending on your financial situation. Contact us to find out!

There are different options ranging from single family or multi-family homes, condominiums, and townhouses. Take a look around your area and let us know what you’re looking for so we can help with the loan!

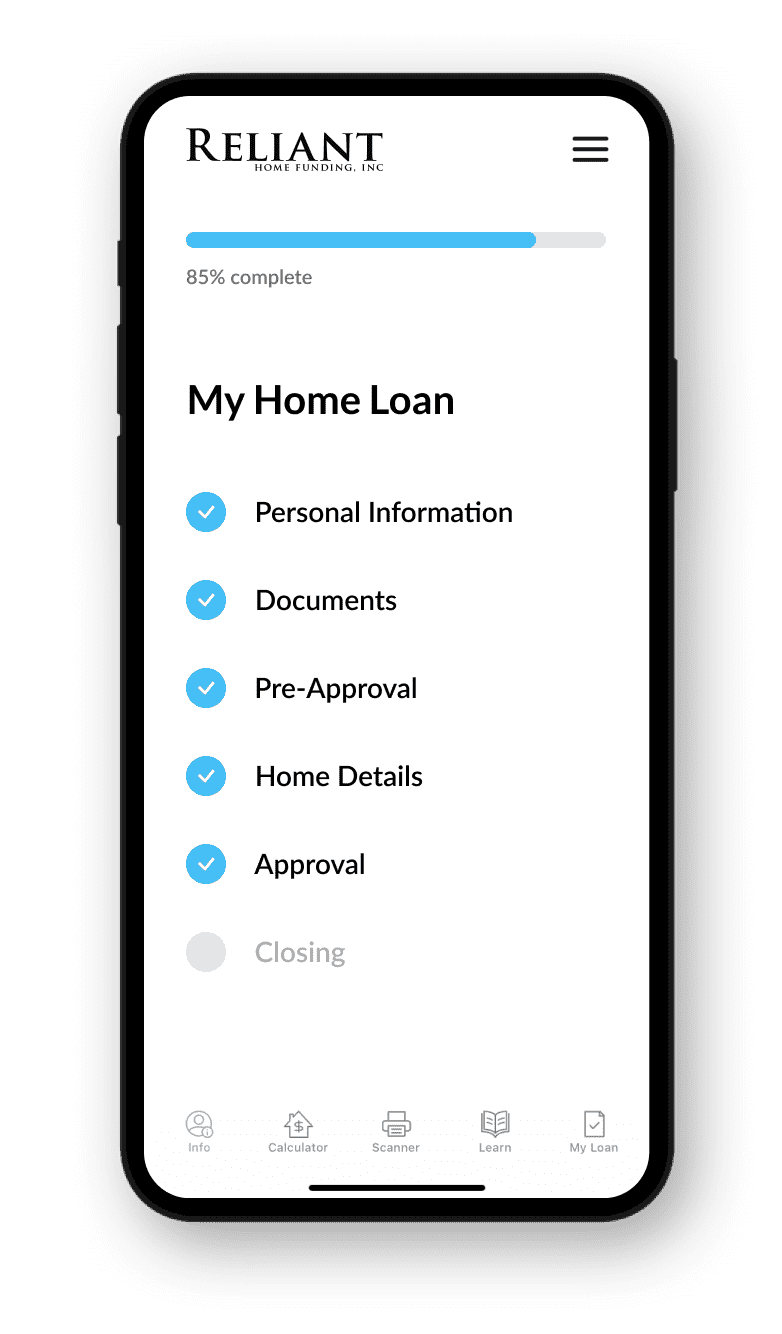

Good news! The home loan process can be done remotely. We also offer RHF GO App for your smartphone so you can stay updated 24/7.

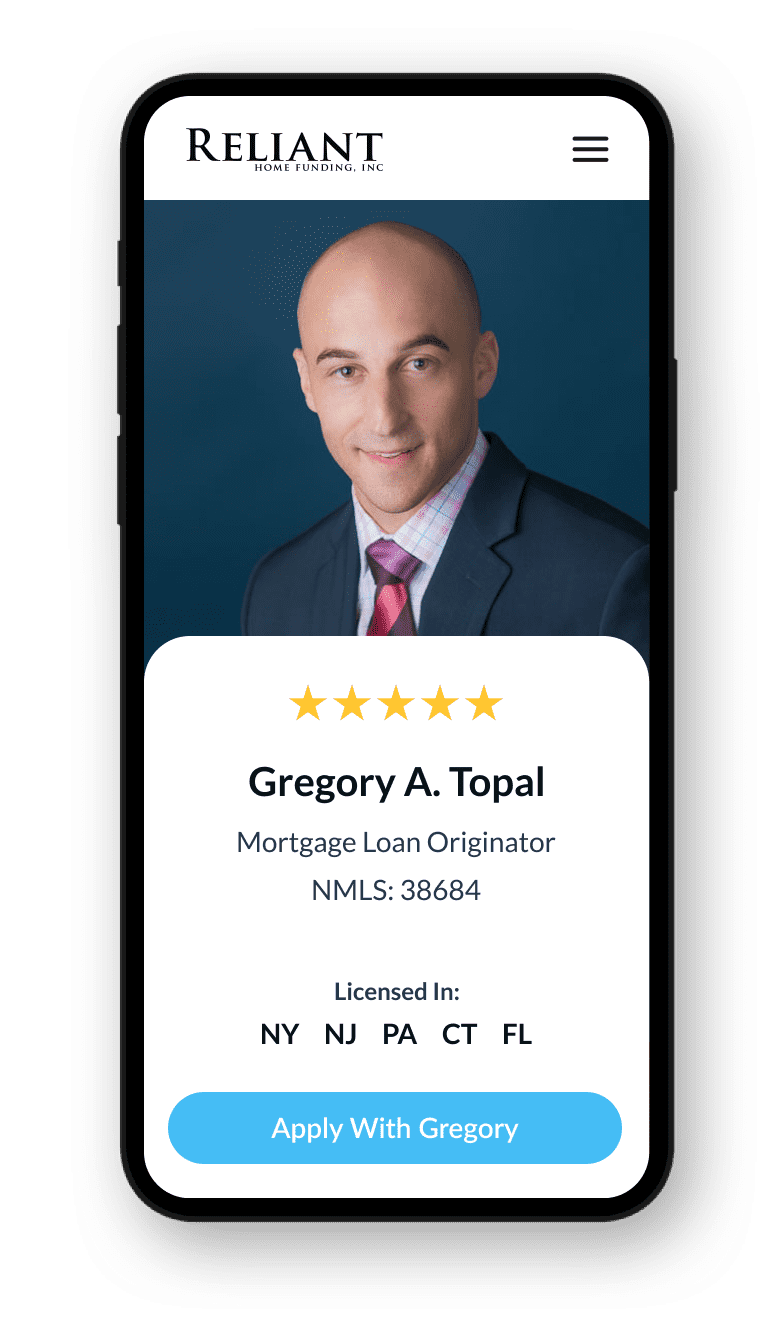

Connect With One Of Our Home Loan Experts

Our People Are Our Greatest Asset

Reliant Home Funding is a family-run business with a strong, valued team – not another nameless and faceless corporation.

Relationships > Transactions

We value changing people’s lives over the bottom line: our motivation and inspiration comes from helping clients into their dream homes.

Transparent & Consistent Pricing

With our highly responsive and knowledgeable loan officers, you’ll never be in the dark about your home loan process and pricing.

Ready for a home loan that fits you perfectly? Get in touch with our experts today to secure yours.

Get My Rates